[ad_1]

Nvidia’s nice earnings and nice progress

When Nvidia introduced its earnings with an astonishing 101% year-over-year progress, it created fairly a stir out there. The corporate’s income for the quarter reached $13.5 billion, surpassing its particular person steerage of $11 billion. Such excellent effectivity is certainly a trigger for celebration.

This distinct progress can most likely be attributed to Nvidia’s strategic place out there. Its GPU chips are in excessive demand for operating giant language fashions and different AI-driven workloads, making the corporate a beneficiary of at present’s know-how panorama. It is price noting that Nvidia laid the inspiration for its present success forward of time.

In a post-earnings dialog with analysts, Collette Kress, Nvidia’s govt vp and chief monetary officer, highlighted the essential function that know-how performs in driving the corporate’s progress. Cloud computing demand from cloud service suppliers and huge Web corporations for patrons, particularly for Nvidia’s HGX platform, has almost tripled year-over-year, he stated. This platform serves as an engine for a big and productive language mannequin.

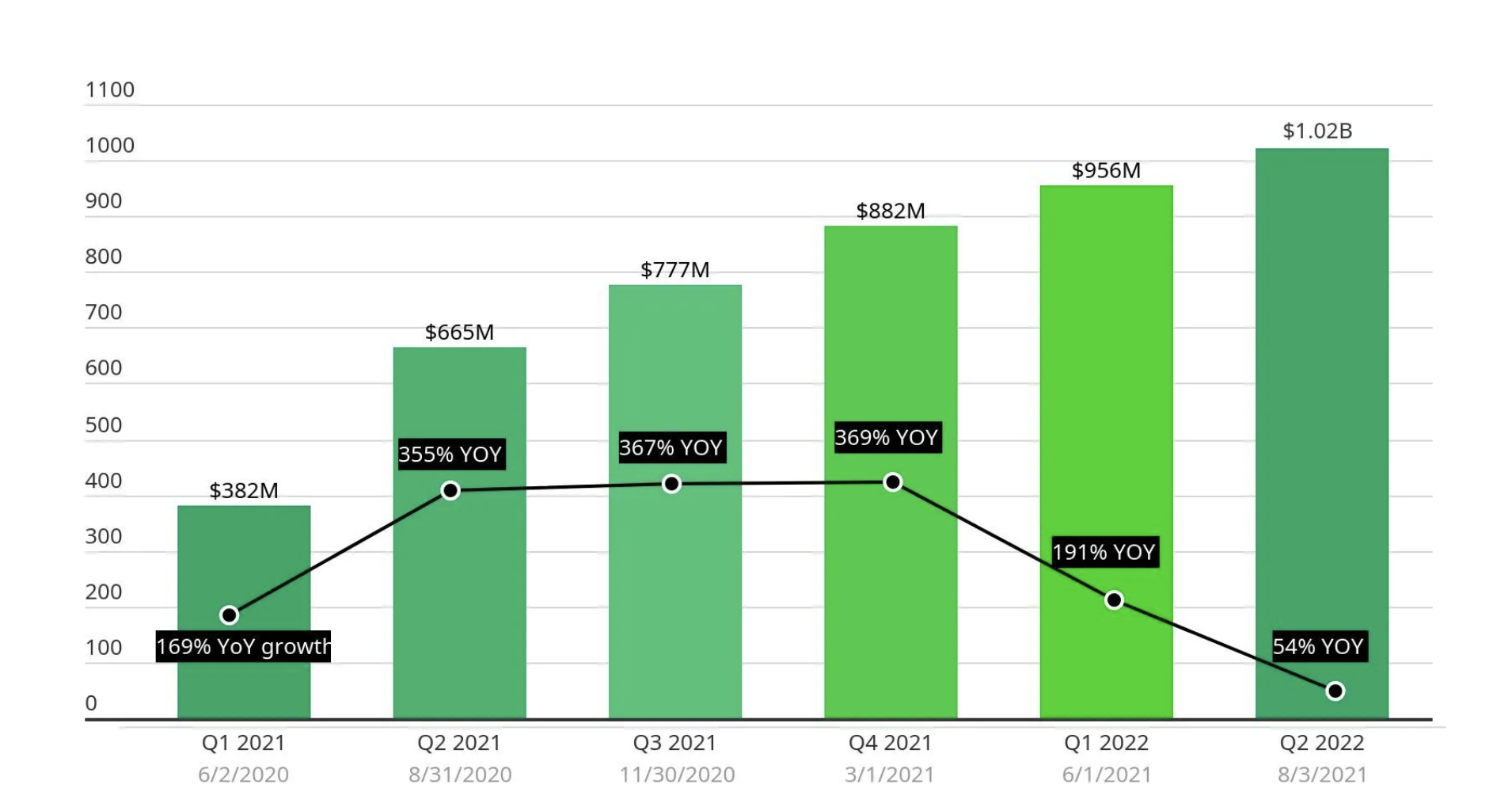

This diploma of progress reminds us of the large rise in cloud shares through the pandemic lockdown. Firms relied closely on SaaS to maintain their workers engaged, which has led to increased inventory costs for corporations like Zoom, which noticed 5 consecutive quarters of astonishing progress.

The Zoom epidemic accelerated progress. Image Credit score rating:

Nonetheless, it is essential to contemplate whether or not or not Nvidia’s progress might observe an identical trajectory to Zoom’s decline. After experiencing a interval of triple-digit progress, Zoom’s progress momentum progressively slowed, reporting a modest 3.6% enhance in income in its newest report. This sample of single-digit progress has continued for five consecutive quarters and raises questions in regards to the sustainability of Nvidia’s present progress and the potential for unrealistic investor expectations.

The best way ahead for information coronary heart demand

One fascinating facet of Nvidia’s progress is within the mid-range phase. Web scalers are quickly increasing their infrastructure and plan to construct greater than 300 new information amenities within the coming years, in accordance with a Synergy Evaluation report. This progress is predicted to be pushed by cloud income, which is projected to develop at an annual price of 20–30%. In consequence, the final expenditure on info will enhance considerably.

Nvidia CEO Jensen Huang believes his firm will profit from this pattern. Through the earnings name, he acknowledged that there are about $1 trillion in info facilities worldwide, with capital spending of a few quarter trillion {dollars} annually. Huang confused that info companies are prioritizing accelerated computing and generative AI, making this a long-term enterprise transition. This alignment between the likes of Nvidia and the first developments in computing might contribute to the company’s continued progress.

Nonetheless, it is vitally essential to acknowledge the affect of enterprise gravity. Regardless of Zoom’s sluggish tempo of progress, the corporate has managed to take care of its earlier scale and proceed to develop. This implies that beforehand speedy progress corporations can nonetheless keep a big presence out there. Whereas this can be much less thrilling to traders, continued progress means flexibility and the flexibility to adapt to altering market circumstances.

conclusion

Nvidia’s present earnings report and its phenomenal progress are undeniably spectacular. The corporate’s strategic place within the synthetic intelligence and data middle markets has fueled its success, significantly with growing demand for cloud computing and language fashions. Nonetheless, as historical past has taught us, continued progress is just not assured and traders’ expectations should be moderated accordingly.

incessantly requested questions

1. What components contributed to Nvidia’s distinctive progress?

Nvidia’s progress will be attributed to the excessive demand for its GPU chips for powering giant language fashions and AI-driven workloads. In addition to, the corporate had already laid the inspiration for its success.

2. Will Nvidia’s progress match Zoom’s decline?

Whereas he is not sure whether or not Nvidia will see a big drop in Xoom’s type, it is essential to contemplate the potential influence of market forces and traders’ altering expectations on the corporate’s future progress.

3. What function has the final demand for info performed in Nvidia’s improvement?

Data middle demand, particularly from internet scalers, is a key driver of Nvidia’s progress. The rising variety of knowledge options, mixed with the drive for accelerated computing and generative AI, presents a promising alternative for Nvidia to take advantage of this market progress.

4. Can Nvidia keep its present stage of progress?

Whereas the Nvidia CEO expressed confidence within the firm’s long-term progress prospects, it is essential to acknowledge that continued progress will not be assured. Plenty of components, akin to market dynamics and aggressive actions, could have an effect on Nvidia’s future efficiency.

For extra info, see this hyperlink

[ad_2]

To entry further info, kindly consult with the next link